Are First Time Buyers Suffering Because Of COVID-19?

COVID-19 has changed the economic position of individuals and businesses significantly within the UK. First time buyers have not been spared from the financial impact of COVID-19, and this demographic has always come up against major challenges when attempting to get their first foot on the property ladder.

The most significant challenges for first time buyers are well known and include saving enough money for the deposit and earning a high enough salary to attain the necessary mortgage.

The Coronavirus pandemic and the job and wage insecurity it causes have put lenders in a position where they are increasingly cautious about lending, and in particular with first time buyers.

According to a recent survey conducted by Trussle:

- 65% of first time buyers say they feel it is impossible to get on the property ladder, with 62% deciding to delay their home-buying efforts and save for a further year.

An Increasingly Confusing Housing Market

The changing lending criteria and deposit requirements are leaving the first time buyer confused, also evidenced in the Trussle survey:

- 76% of first time buyers in the UK say they feel confused, angered, and worried about how COVID-19 has affected their home ownership prospects.

The number of lending products for first time buyers is down. There are now fewer high Loan To Value (LTV) mortgages, and fewer than 4% of mortgage deals with an LTV of over 90%, compared to this time last year.

It is not all bad news because other financial support for first time buyers remains in place. The Help to Buy, Right to Buy/Acquire, and Shared Ownership Schemes are three examples of the financial support available. Furthermore, Chancellor Rishi Sunak once again extended the Stamp Duty Holiday (originally planned to end on March 31st, 2021). The Stamp Duty Holiday will now come to an end in June 2021, with a tapering off period that will run to the end of September and will save home buyers up to £15,000.

However, first time buyers may still need to look further afield in more affordable areas and consider if working from home is a viable long-term option for them before making a purchasing decision.

Post COVID Outlook

While property viewings, valuations, and sales continued through the latest bout of lockdown measures, the housing market’s recovery can only be achieved by including the buying power of the first time home buyer.

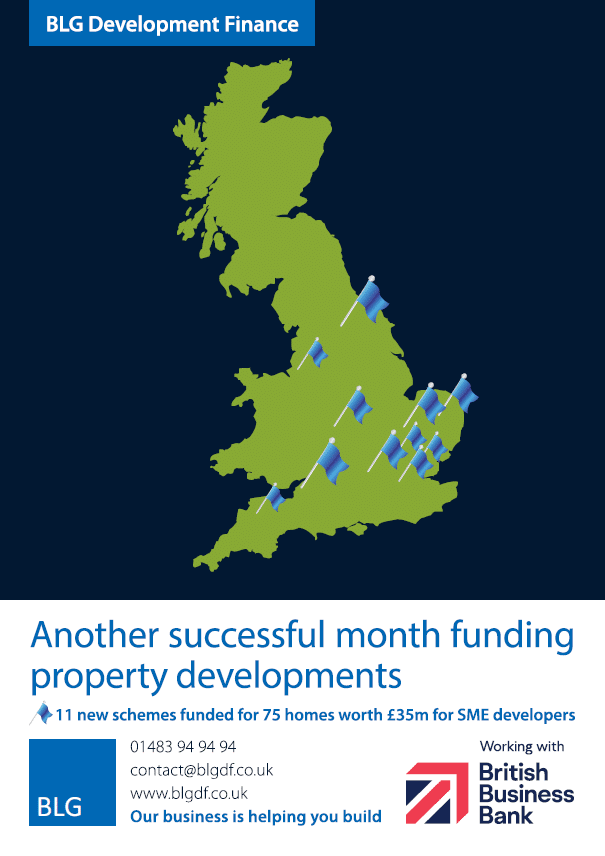

Property availability continues to be an issue. COVID-19 is adding three to eight months to new residential development build times, delaying the completion of 250,000 homes. However, residential development finance is helping property developers acquire financing and complete projects, which will ultimately improve availability.

For more information on the help available for first time buyers and residential property developers, please contact the BLG team.