Connecting Developers With The Right Mezzanine Finance Provider

12-24 months

Terms between 12 and 24 months

90%

Up to 90% loan to cost

Second charge, 100% secured on property

£3,000,000

Loans from £100,000 to £3,000,000

Mezzanine Debt Finance Overview:

- Loans from £100,000 to £3 million

- Up to 90% loan to cost

(70% loan to Gross Development Value) - Terms 12 to 24 months

- Loans can include part of the land purchase cost

- Second charge, 100% secured on property

Mezzanine Finance Funding Criteria:

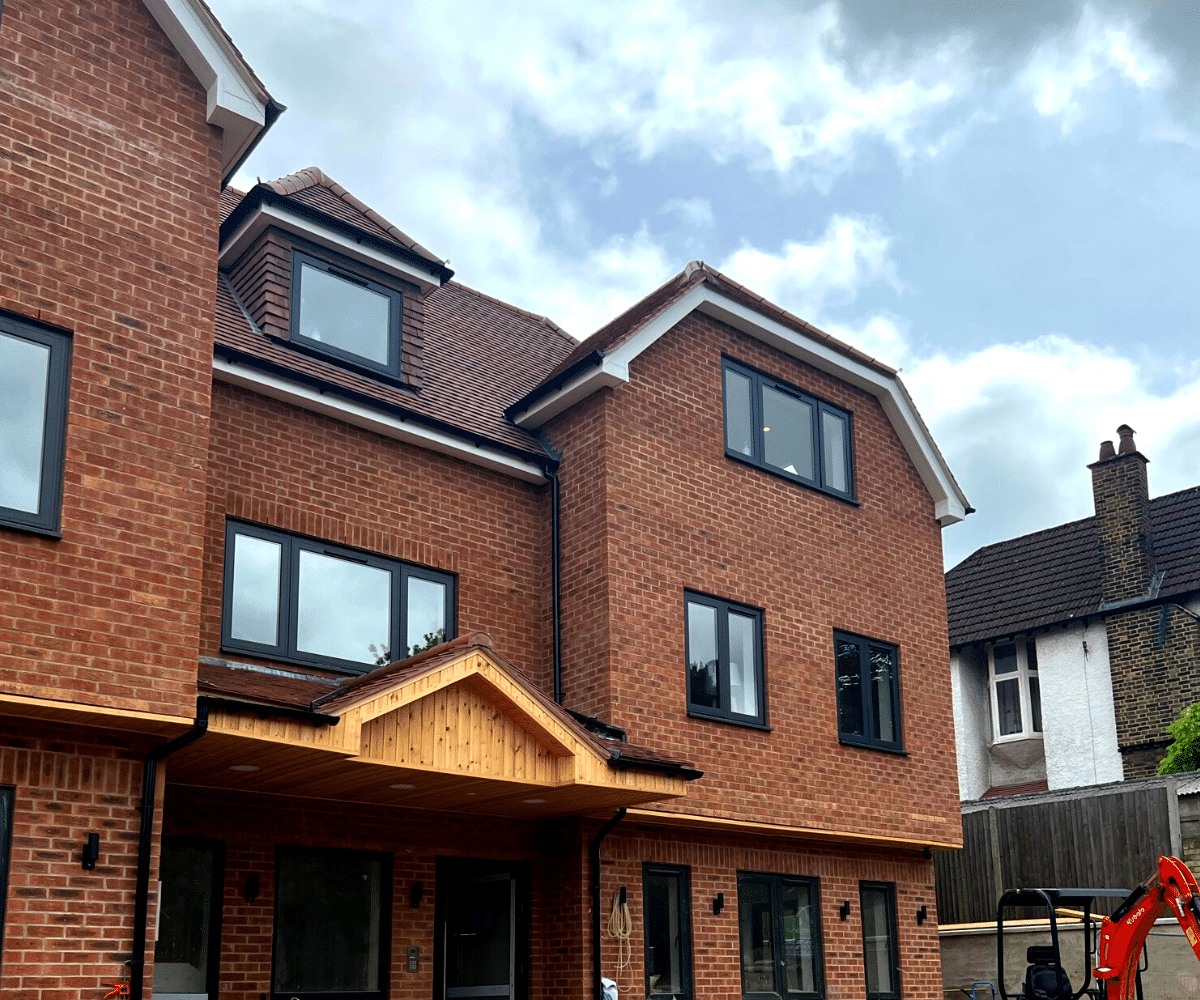

- Residential: houses, flats, new build, conversions and mixed-use

- Property with a commercial aspect considered

- Property across the UK in areas with strong demand

- Sites to have outline planning in place.

What Is Mezzanine Development Finance, And What Is Its Purpose?

Mezzanine development finance, often referred to as a mezzanine loan or mezz loan, represents secondary debt financing that is extended to property developers with the primary aim of supplementing the existing financing for a development project.

Mezzanine finance in property development is a specialised form of financing that plays a pivotal role in facilitating complex real estate projects. It derives its name from the fact that it occupies a middle or “mezzanine” position in the capital stack, which includes senior debt (such as traditional bank loans) and equity investment. To understand it better, let’s delve into the details of what mezzanine finance for property development entails:

- Additional Capital: Mezzanine finance provides property developers with an additional source of capital, often in the form of loans. This capital is typically used to bridge the gap between the equity invested by the developer and the senior debt secured from traditional lenders. Mezzanine lenders take on a higher level of risk compared to senior lenders, which is reflected in the interest rates and terms they offer.

- Risk and Reward: Mezzanine financing is considered a riskier form of lending because it is subordinate to senior debt. In other words, if the project encounters financial difficulties or defaults, the senior debt holders get paid before the mezzanine lender. To compensate for this added risk, mezzanine lenders typically charge higher interest rates than traditional lenders. However, in exchange for this higher risk, they also stand to earn potentially higher returns if the project is successful.

- Flexible Terms: Mezzanine loans often come with more flexible terms than senior debt, making them attractive to developers. These terms can include things like payment structures, interest rates, and maturity dates. The flexibility allows developers to tailor the financing to their specific project needs.

- Project Enhancements: Mezzanine finance is often used to enhance a project’s overall capital structure. Developers can use these funds for various purposes, such as acquiring additional properties, covering construction costs, or even as working capital to manage day-to-day expenses during the development process.

- Cash Flow Improvement: Mezzanine finance can also improve a developer’s cash flow. By securing mezzanine loans, developers can reduce their immediate equity contribution to a project, freeing up capital for other investments or future developments.

- Scaling Opportunities: Developers can leverage mezzanine finance to take on larger and more ambitious projects than they would be able to with just senior debt and equity. This opens up opportunities for growth and diversification within the real estate market.

In summary, mezzanine finance in property development is a strategic tool that helps developers bridge the financing gap, enhance their capital structure, and pursue larger and more lucrative real estate ventures. While it carries higher risk, its flexibility and potential for increased returns make it an attractive option for experienced developers looking to optimise their project financing. However, developers should carefully consider their financial strategy and risk tolerance before engaging in mezzanine financing.

This financing instrument serves as a valuable tool for property developers, primarily by enhancing their cash flow and enabling them to explore additional development opportunities. If you’re seeking further insights or looking to advance your next residential project, please don’t hesitate to get in touch with BLG today. We’re here to assist you in achieving your goals.