Stretch Senior Development Finance

Stretch Senior Loans

Our Stretch senior development finance loans offer a diverse range of funding solutions designed to support and expand your development efforts. We provide financial backing covering up to 90% including rolled-up interest. Additionally, we offer financing up to 75% of the gross development value, when accounting for rolled-up interest. Our offered rates are negotiable based on the complexity and debt quantum of any individual project.

We offer senior loans ranging from £1,000,000 to £15,000,000, providing the flexibility needed to match your project’s scale and requirements. Our financing solutions cater to projects with timelines of up to 24 months, accommodating both large-scale developments and smaller ventures. Whether you’re embarking on a major development or a more modest project, our stretch senior loans are designed to provide the robust financial support necessary to advance your goals and bring your vision to life.

24 months

Loan terms up to 24 months

90%

Up to 90% loan to cost including interest

£15,000,000

Loans from £1,000,000 to £15,000,000

What Exactly Is Stretch Senior Debt?

At first glance, the concept of a stretch finance loan, sometimes referred to as an over advance loan, might seem intricate, but its essence is quite straightforward. These specialised financing options are crafted by experts in the realm of property development finance, such as BLG, to provide property developers with access to a higher level of financial support.

Stretch senior debt distinguishes itself by typically offering a more substantial loan-to-cost or loan-to-value ratio than what is conventionally available from mainstream lenders and banks. For instance, while traditional banks might extend loans covering up to 60% of project costs, our stretch senior loans are accessible for up to 90% of project costs, with the potential to reach 90% when considering rolled-up interest. Another perspective on stretch senior development finance is that it can encompass up to 65% of the Gross Development Value, potentially increasing to 75% when rolled-up interest is factored in.

In practical terms, this means that while conventional banks and high street lenders may expect property developers to inject cash equivalent to 40% of project costs into the venture, we offer the flexibility for developers to contribute as little as 13% of their project expenses when incorporating rolled-up interest. This approach empowers developers to leverage their resources more efficiently and optimize their capital allocation for their development projects.

Share Your Project Details And Give Us A Call

If you’re interested in finding out if a development loan could work for you, simply share some details and get in touch. Our team of property finance experts will have a chat with you to see if we can help.

We’ll Find The Right Solution Together

Tell us about your project, and using our knowledge and experience, our team will work with you to create a customised solution that fits your goals. We’ll also walk you through the process, so you understand the next steps.

Get A Quick Answer

We’ll provide you with our heads of terms quickly. If they meet your needs, just send us a full application to proceed. From there, a credit review will take place, leading to an offer backed by our commitment.

Funds Are Released After Due Diligence

Once our verification process is complete (typically 6-8 weeks depending on the complexity), you can expect to receive your funds. Now you can get back to what you do best while we take care of the financing.

What Are The Key Features Of Stretched Senior Debt?

One of the primary features of Stretched Senior Debt is the higher loan-to-value (LTV) ratio it offers. While traditional senior debt loans typically have an LTV ratio of around 60% to 65%, Stretched Senior Debt can provide financing up to 70% LTV or even higher. This increased leverage allows developers to secure more funds for their projects and reduces the amount of equity they need to contribute.

What Is Senior Development Finance Used For?

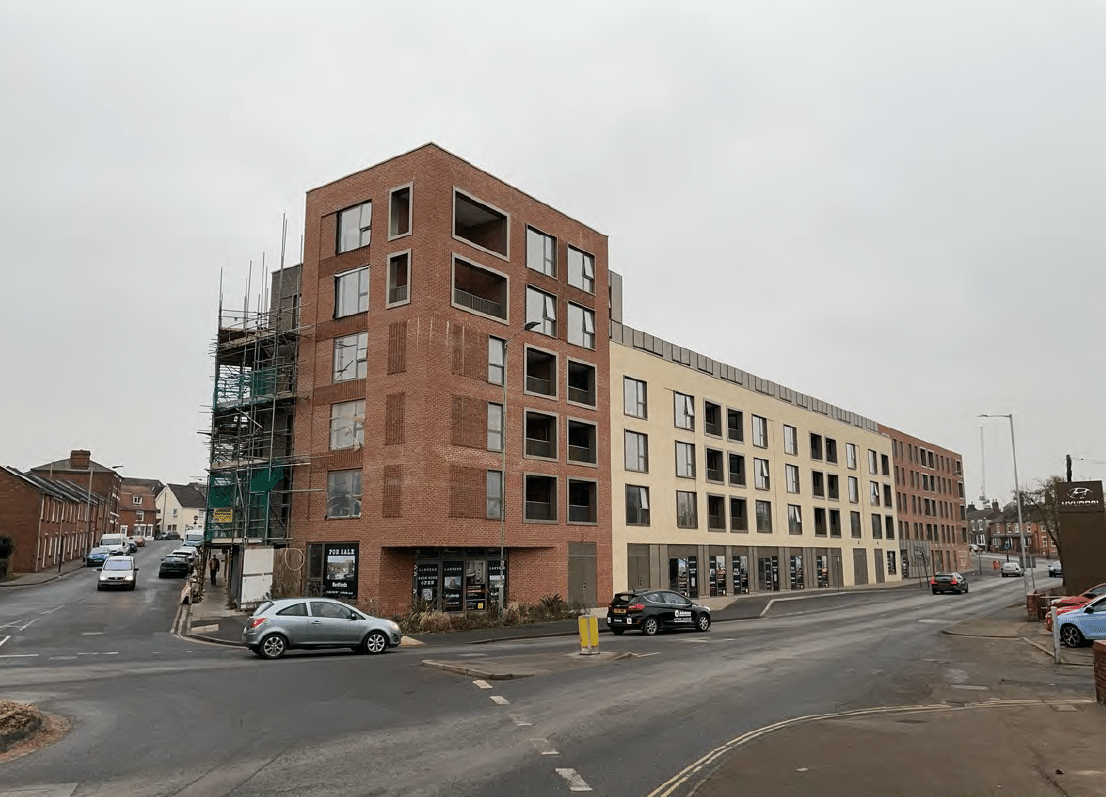

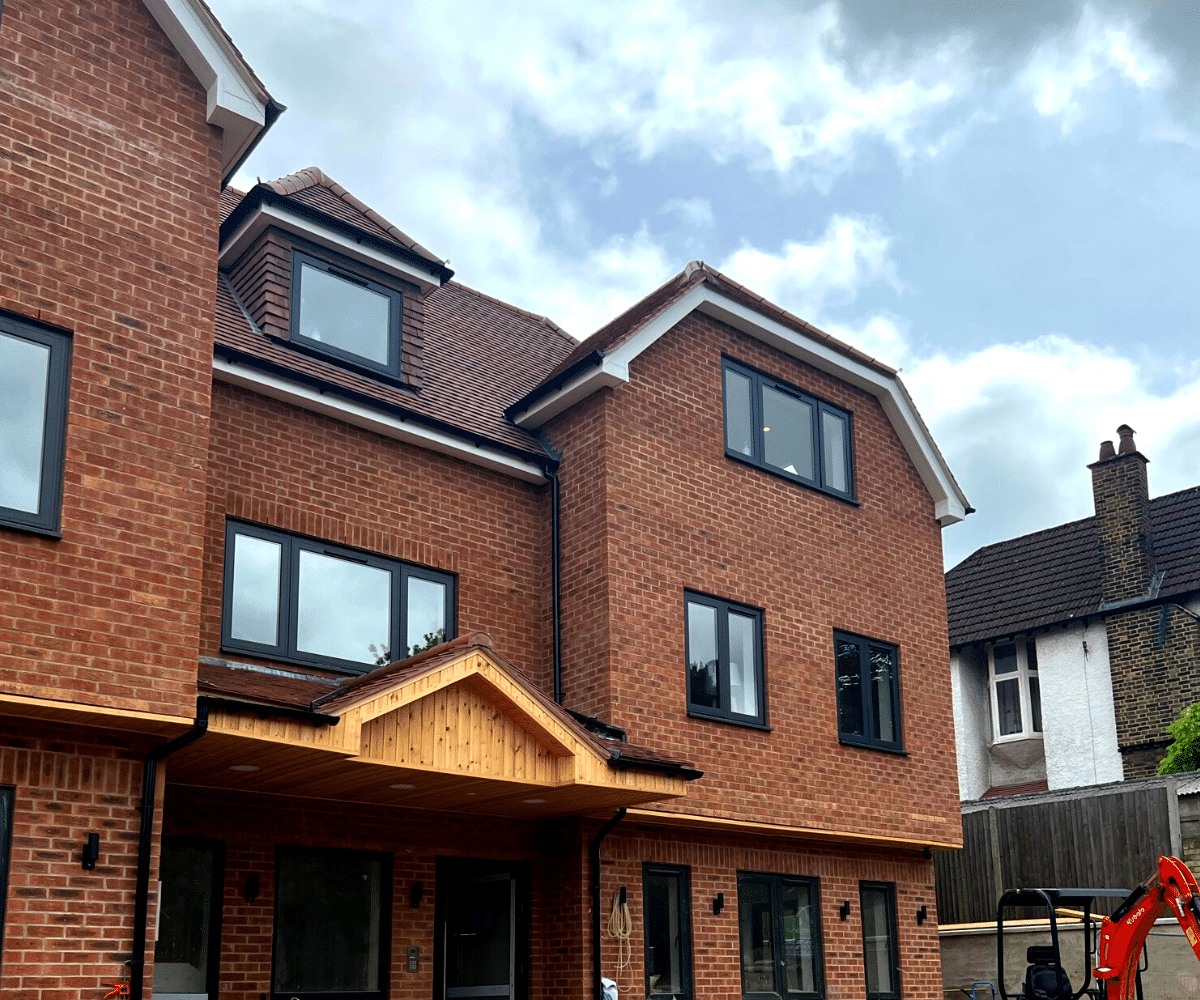

Our stretch senior debt can be used for a wide range of residential developments, including houses, apartments, new builds, and conversions. Our development finance solutions extend to mixed-use schemes, accommodating projects in both urban and rural locations across the UK. We aim to support developments in areas with strong demand, enabling you to capitalise on market opportunities. Whether you’re planning a small-scale project or a large-scale endeavour. There are no restrictions on the number of units you can develop. Our stretch senior finance is tailored to meet the diverse needs of residential developers, providing the necessary funding to bring your projects to fruition.

What Are The Stretched Senior Debt Lending Criteria?

Development Demand: One crucial criterion is the location of the development project. Lenders look for projects in areas with clear sales demand, ensuring that there is a market for the developed properties. Factors such as population growth, economic indicators, market trends, and demand for real estate in the area are assessed to determine the viability of the project.

Loan-to-Cost Ratio: Lenders consider the loan-to-cost (LTC) ratio when evaluating Stretched Senior Debt applications. The LTC ratio represents the loan amount as a percentage of the total project cost, including land acquisition, construction costs, and other related expenses. Lenders typically have their own predetermined limits for the LTC ratio, and the proposed loan amount must fall within this range to be eligible for Stretched Senior Debt financing.

Why Is Stretch Senior Development Finance Helpful For Property Developers?

Property developers and house builders find this higher leverage lending helpful as it means they do not need to provide such a large percentage of funding themselves. This not only helps with cash flow, for many it allows the opportunity to build more than one development project at a time.

What Information Would I Need To Provide?

- Applicant company name and details

- Directors & significant shareholders details

- Full site/property address details

- Copy of the planning consent

- Financial appraisal and cash-flow

- Detailed build costs

- Details of the professional team such as architect and structural engineer

- Procurement method such as construction management

- Any comparable sales information to support the proposed GDV

A senior stretch loan is quick, efficient, and convenient, giving you access to more finance while only dealing with one lender.

A senior stretch loan is quick, efficient, and convenient, giving you access to more finance while only dealing with one lender. We also offer build to let and mezzanine development finance all for residential projects. Contact us today to be put in touch with your local BLG Regional Director who will be happy to discuss your property development funding requirements.