BLG Provided Funding Solution That Standard Lenders Couldn’t Match

Development:

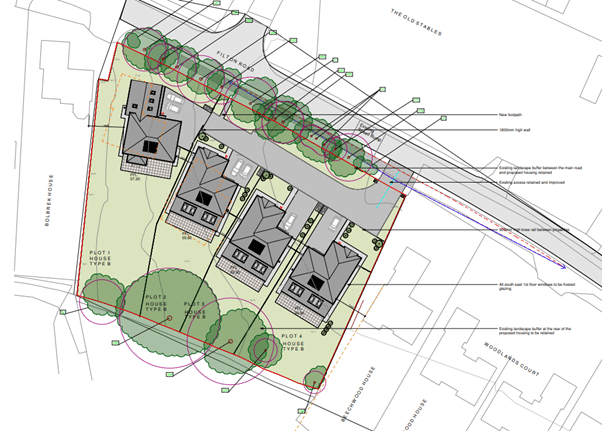

Construction of 15 new-build family homes following the demolition of an existing dwelling on a 1.2-acre backland site in Moulton, Northamptonshire. The scheme comprises a mix of 2, 3, and 4-bedroom detached and semi-detached houses, each with private gardens and off-street parking. BLG provided a £5 million development loan at 70% LTGDV using additional security to back the borrower under the government-backed Recovery Loan Scheme, enabling acquisition and build funding. Addressing rising demand for high-quality suburban housing near Northampton, the project benefits from a prime village location just five miles from Northampton town centre, positioned in an expanding residential area supported by national housebuilders.

This was the borrower’s first project of this scale – but thanks to BLG’s flexible approach, we delivered a funding solution that standard lenders couldn’t match.

This scheme is now complete, and the borrower has since returned to BLG for further schemes.

Developer:

The borrower is a new joint venture established by experienced construction professionals who previously served as contract and site managers overseeing multiple large-scale housing projects and operates successful scaffolding and building services companies supplying national developers. They bring strong operational expertise, hands-on delivery capability, and a track record of smaller residential schemes across Northamptonshire.

Location: Moulton, Northamptonshire

GDV: £6.56 million

Loan Type: Residential Development Finance / Recovery Loan Scheme

Loan Term: 18 months

At BLG, we don’t just fund projects – we build relationships. By going beyond standard criteria, we help both developers and brokers deliver ambitious projects and grow with confidence.