Who Is Eligible For Build To Let Development Finance

Whether you’re a first-time investor or an experienced property developer, delving into the lucrative rental market often requires financial support. The build to let finance option provides a tailored solution for those seeking long-term returns through rental properties.

The build to let development finance is used to fund the project during the build phase. Once the build is completed, the investor or developer will exit onto a standard buy to let product. Where five to ten apartments exist in a building, a single standard buy-to-let mortgage is typically available. When there are more than ten apartments and additional facilities, such as an on-site gym, then a specialist commercial buy to let product will be called for.

To fund the project during the build phase, investors and developers often turn to build to let development finance, transitioning to a standard buy to let product upon completion.

Eligibility

When considering build to let finance, adherence to specific eligibility criteria becomes paramount. Lenders meticulously evaluate various factors to ensure the viability and success of the project. The lending criteria for build to let funding is evidence of a strong exit strategy, which is typically a buy to let mortgage that is agreed in principle. Here’s a detailed exploration of the key eligibility criteria:

Strong Exit Strategy: A fundamental requirement for accessing build to let finance is the demonstration of a robust exit strategy. This often takes the form of a pre-approved buy to let mortgage. This strategic plan outlines how the investor or developer intends to transition from the initial funding phase to a standard buy to let product upon project completion.

Track Record and Experience: Investors and developers with a proven track record in the sector and a history of successful developments enhance their eligibility. Previous experience in navigating the intricacies of property development is a valuable asset, instilling confidence in lenders regarding the project’s potential for success.

Comprehensive Business Plan: The submission of a well-structured business plan is a critical component of eligibility. This plan should go beyond a mere overview, delving into key metrics such as occupancy forecasts and rental projections. A comprehensive business plan not only outlines the project’s financial viability but also showcases the investor or developer’s strategic vision.

Creditworthiness: While good credit is generally preferred, lenders understand that certain circumstances may lead to less-than-perfect credit histories. In such cases, eligibility is still possible, provided the poor credit does not pose a significant threat to the exit strategy. Lenders may assess the overall financial health and stability of the applicant.

Security and Deposit: Offering good security and a deposit higher than the minimum requirement are viewed as indicators of lower risk. A higher deposit showcases the applicant’s commitment and financial stability, strengthening eligibility. Security, in the form of collateral or assets, provides assurance to lenders and mitigates potential risks associated with the financing.

Understanding and fulfilling these eligibility criteria not only increases the likelihood of securing build to let finance but also sets the stage for a successful and sustainable project in the competitive property market. Aspiring investors and developers are encouraged to work closely with financial experts and advisors to navigate the intricacies of the application process and optimise their eligibility for build to let finance.

Strengthening Your Position

There are strategic avenues for those seeking to fortify their eligibility or address capital shortfalls. Here, we delve into alternative options designed to strengthen your financial position:

Bridging Loans: Bridging loans serve as invaluable short-term solutions, especially when some capital is available but falls short of the project’s requirements. These loans provide the flexibility to swiftly acquire a portion of the site, facilitating progress while the investor or developer works towards securing additional funding. Bridging loans act as a financial bridge, enabling seamless movement from one phase of the project to the next.

Equity Release: A strategic approach involves tapping into the equity within your existing investment portfolio. By remortgaging properties, investors and developers can unlock additional funds to bolster their financial capacity. Equity release allows for the efficient utilisation of existing assets to secure the necessary resources for the build to let project. This option leverages the accrued value of your properties, providing a dynamic source of financing.

Unsecured Business Loans: For those seeking a supplementary financial boost of up to £25,000, unsecured business loans present a viable solution. These loans, not backed by specific collateral, offer flexibility and a streamlined application process. While the loan amount may be relatively smaller compared to other financing options, unsecured business loans serve as a convenient top-up, filling gaps in capital and supporting various project-related expenses.

Considering these alternative options allows investors and developers to adapt to the ever-evolving financial landscape of property development. Each avenue offers a distinct set of advantages, catering to specific needs and circumstances. It is crucial to carefully assess your financial requirements, risk tolerance, and overall project goals when determining which alternative option aligns best with your unique situation.

Collaborating with financial experts and advisors is advisable to navigate the nuances of each alternative, ensuring informed decision-making. By strategically utilising bridging loans, equity release, or unsecured business loans, you can fortify your financial position, enhancing your ability to embark on successful build to let projects with confidence and resilience.

Important Considerations

Before embarking on a buy to let project, it’s crucial to be aware of key factors, such as potential challenges in finding buyers, higher interest rates for short-term finance, and the time it might take for rental incomes to materialise.

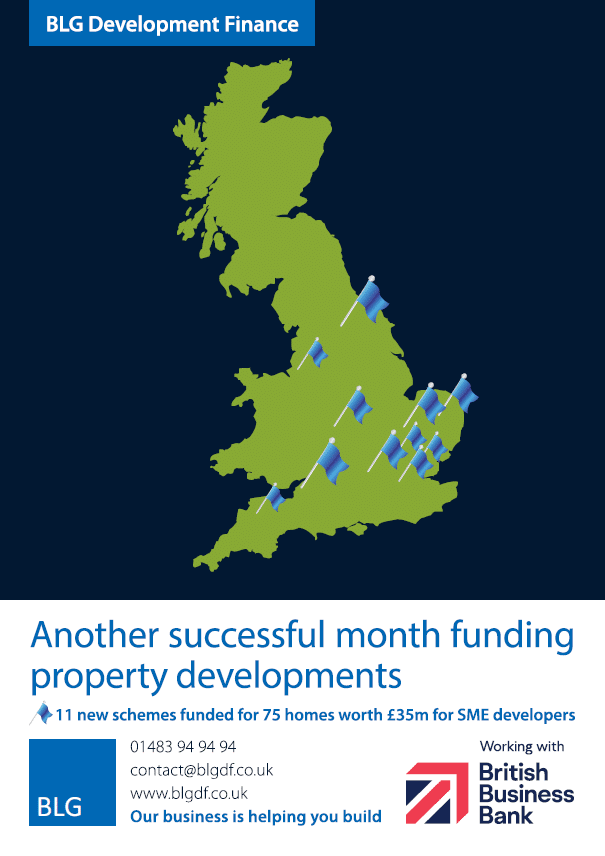

For tailored advice and information on build to let finance, landlords and property developers are encouraged to reach out to the experienced team at BLG. Their expertise can guide you through the intricacies of financing, ensuring your project’s success in the competitive rental market. For more information on build to let finance for landlords and residential property developers, please contact the BLG team.